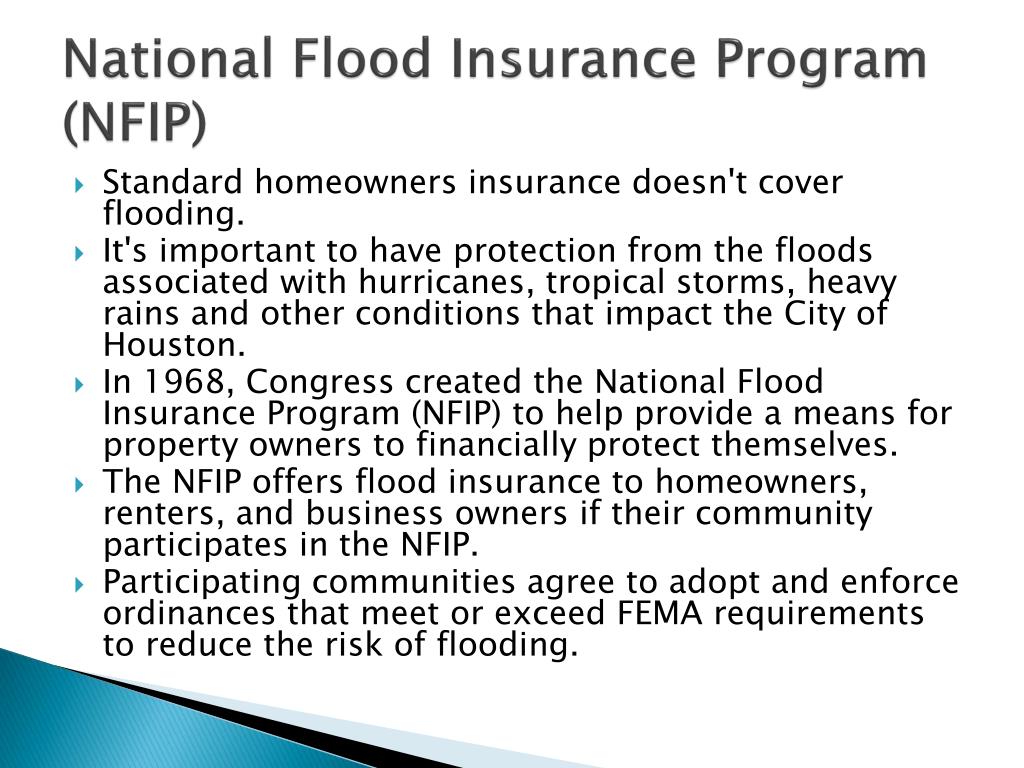

NFIP's Risk Rating 2.0įEMA is updating the National Flood Insurance Program's insurance risk rating through a new pricing methodology called Risk Rating 2.0- Equity in Action. In general, homeowners insurance does not provide protection from damages to a structure or to contents caused by flooding and it is necessary for property owners to have a separate flood insurance policy to cover a loss cause by a flood. Collapse or subsidence of land along the shore of a lake or similar body of water as a result of erosion or undermining caused by waves or currents of water exceeding anticipated cyclical levels that result in a flood.Unusual and rapid accumulation or runoff of surface waters from any source or.The partnership is established on the provision that FEMA will make flood insurance available to the citizens of a community, provided that the community implements floodplain management regulations that meet or exceed the Federal minimum requirements.Ī "flood" is defined as a general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties (at least one of which is the policyholder's property) from: The NFIP is designed so that floodplain management and flood insurance complement and reinforce each other. The intent of the legislation is to help reduce future flood damage through floodplain management criteria and to provide protection to property owners through an insurance mechanism. Subsequent passage of the Flood Disaster Protection Act of 1973, the National Flood Insurance Reform Act of 1994 and the Flood Insurance Reform Act of 2004 further modified and strengthened the original 1968 Act.

Congress established the National Flood Insurance Program (NFIP) with the passage of the National Flood Insurance Act of 1968. In exchange, the Federal Government makes flood insurance available as a financial protection against flood losses. Participation in the NFIP is voluntary and is based on a community's agreement to adopt and enforce, at a minimum, the Federal standards for building within a Special Flood Hazard Area (SFHA). The goal of the program is to help mitigate future losses caused by flooding through community enforced building standards.

The National Flood Insurance Program (NFIP) was created with the passage of the National Flood Insurance Act of 1968.

0 kommentar(er)

0 kommentar(er)